Table of Contents

- Introduction

- Understanding Risk Management in Oil & Gas

- Importance of Risk Management

- Types of Risks in Oil & Gas Projects

- Risk Assessment Methodologies

- Strategies for Risk Mitigation

- The Role of Training in Risk Management

- Essential Resources

- FAQs

- Conclusion

Introduction

Navigating the complexities of oil and gas projects requires a robust approach to risk management. In this dynamic industry, understanding how to identify, assess, and mitigate risks is vital for success. Organizations face numerous challenges, from fluctuating market prices to environmental concerns, making effective risk management an essential skill set.

Understanding Risk Management in Oil & Gas

Risk management involves the systematic identification and analysis of risks, followed by coordinated efforts to minimize, control, or eliminate their impact. In the oil and gas sector, stakeholders deal with both technical and non-technical risks. A clear comprehension of these risks lays the groundwork for effective decision-making.

Key Components of Risk Management

- Risk Identification

- Risk Analysis

- Risk Evaluation

- Risk Treatment

- Risk Monitoring and Review

Importance of Risk Management

Implementing a solid risk management framework not only protects assets but also enhances project performance. Let’s explore the significance of risk management in the oil and gas realm.

1. Enhancing Safety

Safety is paramount in oil and gas projects, where potential hazards lurk. A structured approach to risk management proactively addresses safety concerns, ensuring that workers remain secure and that compliance with regulations is maintained.

2. Financial Protection

Financial risks can dramatically affect the viability of projects. By using solid risk management strategies, organizations can protect themselves against financial downturns and unexpected expenditures.

3. Improving Decision-Making

Data-driven decisions emerge from thorough risk analysis, helping stakeholders understand potential consequences and make informed choices that align with strategic goals.

Types of Risks in Oil & Gas Projects

Understanding the various types of risks specific to oil and gas projects helps organizations anticipate potential challenges. Below are some common categories of risks:

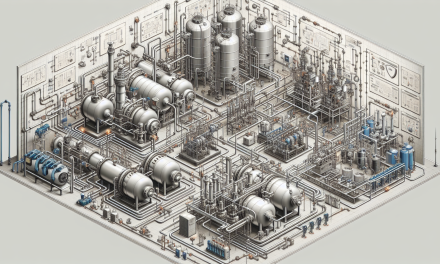

1. Operational Risks

These relate to the day-to-day functioning of operations. Inefficiencies, equipment failures, and supply chain disruptions fall under this category.

2. Environmental Risks

Oil and gas activities pose significant environmental concerns. From spills to emissions, managing these risks is essential for safeguarding natural resources and adhering to environmental regulations.

3. Market Risks

Market volatility can impact profitability. By staying informed about market trends, oil and gas companies can better prepare for fluctuations.

4. Regulatory Risks

Changes in legislation or non-compliance with existing regulations can result in severe penalties. Thus, staying abreast of regulatory frameworks is necessary for risk management.

Risk Assessment Methodologies

Employing effective risk assessment methodologies provides organizations with the tools necessary to evaluate risks accurately. Here are some popular approaches used in the industry:

1. Qualitative Risk Analysis

This involves assessing risks based on their severity and likelihood through expert judgment and experience, often using risk matrices.

2. Quantitative Risk Analysis

Utilizing numerical methods, quantitative analysis allows for a more precise evaluation of potential impacts and probabilities, relying on statistical techniques.

3. Bowtie Analysis

Combining elements of qualitative and quantitative assessments, Bowtie analysis visually maps out risks, detailing preventive and mitigative control measures.

Strategies for Risk Mitigation

Once risks are identified and assessed, organizations must develop strategies to mitigate them. Here are some effective strategies:

1. Establishing Contingency Plans

Preparing contingency plans allows teams to act swiftly in the event of unforeseen circumstances, ensuring that projects continue to run smoothly.

2. Investing in Technology

Utilizing advanced technology can significantly enhance safety and operational efficiency. Tools such as data analytics and real-time monitoring systems help mitigate risks.

3. Training and Development

Regular training keeps employees informed about the latest risk management practices and safety protocols. Knowledgeable personnel can better identify and address risks effectively.

The Role of Training in Risk Management

Continuous learning plays a crucial role in risk management for oil and gas projects. The importance of comprehensive training programs cannot be overstated, as they equip teams with the skills and knowledge necessary to tackle potential risks head-on.

One well-structured program worth considering is the Oil & Gas Project Risk Management Certification Course. This certification provides valuable insights and practices to enhance risk management efforts, ultimately leading to successful project outcomes.

Essential Resources

Furthermore, several invaluable resources exist that can assist professionals in navigating the complexities of risk management in the oil and gas sector. These include informative articles that dive deeper into various aspects of the industry:

- Comprehensive Financing Solutions for Oil & Gas Mining Projects

- Unlocking Success: The Essential Guide to Oil and Gas Project Management

- Mastering Project Management in the Oil and Gas Industry: A Comprehensive Guide

- Mastering Oil & Gas Accounting: Unlocking Performance Metrics for Success

FAQs

1. What is risk management in the oil and gas industry?

Risk management in the oil and gas industry involves identifying, assessing, and mitigating potential risks that could impact projects. It aims to enhance safety, protect financial investments, and improve decision-making.

2. Why is training important for risk management?

Training is vital as it equips professionals with the knowledge and skills to effectively manage risks. Continuous education helps teams stay updated on best practices and regulatory changes.

3. What are the main types of risks in oil and gas projects?

The main types of risks include operational, environmental, market, and regulatory risks. Each category requires careful assessment and mitigation strategies.

Conclusion

In conclusion, effective risk management is essential for the success of oil and gas projects. By understanding risks, implementing robust assessment methodologies, and prioritizing training, organizations can reduce potential setbacks significantly. As the industry evolves and faces new challenges, commitment to comprehensive risk management will serve as a crucial factor in ensuring longevity and profitability. Continuous learning and adaptation remain key components of successful risk management strategies, leading to enhanced performance and safety in the oil and gas sector.